Strength after a Market-Wide Drop

Identifying robust projects in the market can be insightful, especially following a significant market downturn.

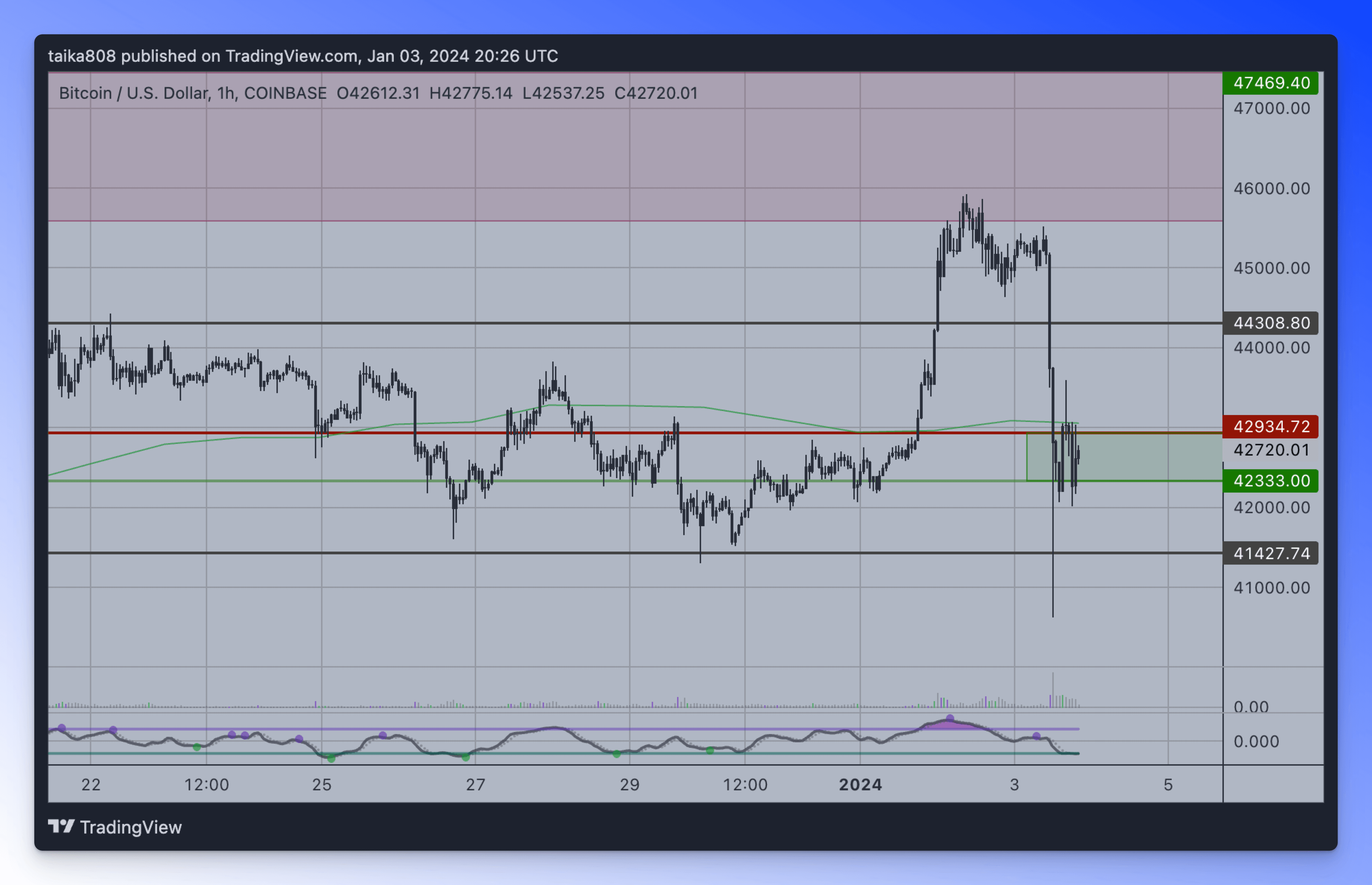

For instance, when Bitcoin experiences a substantial and sudden price drop, it often leads to a downturn across the broader crypto market. These market movements are frequently just shakeouts, intended to eliminate less committed investors, or 'weak hands.'

Observing how different assets react after such a drop can be valuable. Liquid assets that demonstrate a strong recovery might be influenced by an upcoming positive catalyst or possess inherent market strength, making people hesitant to sell. Instead, they might seize the opportunity to buy during the downturn, anticipating future gains.

Methodology

Discover assets demonstrating relative strength using Inuali with these strategies:

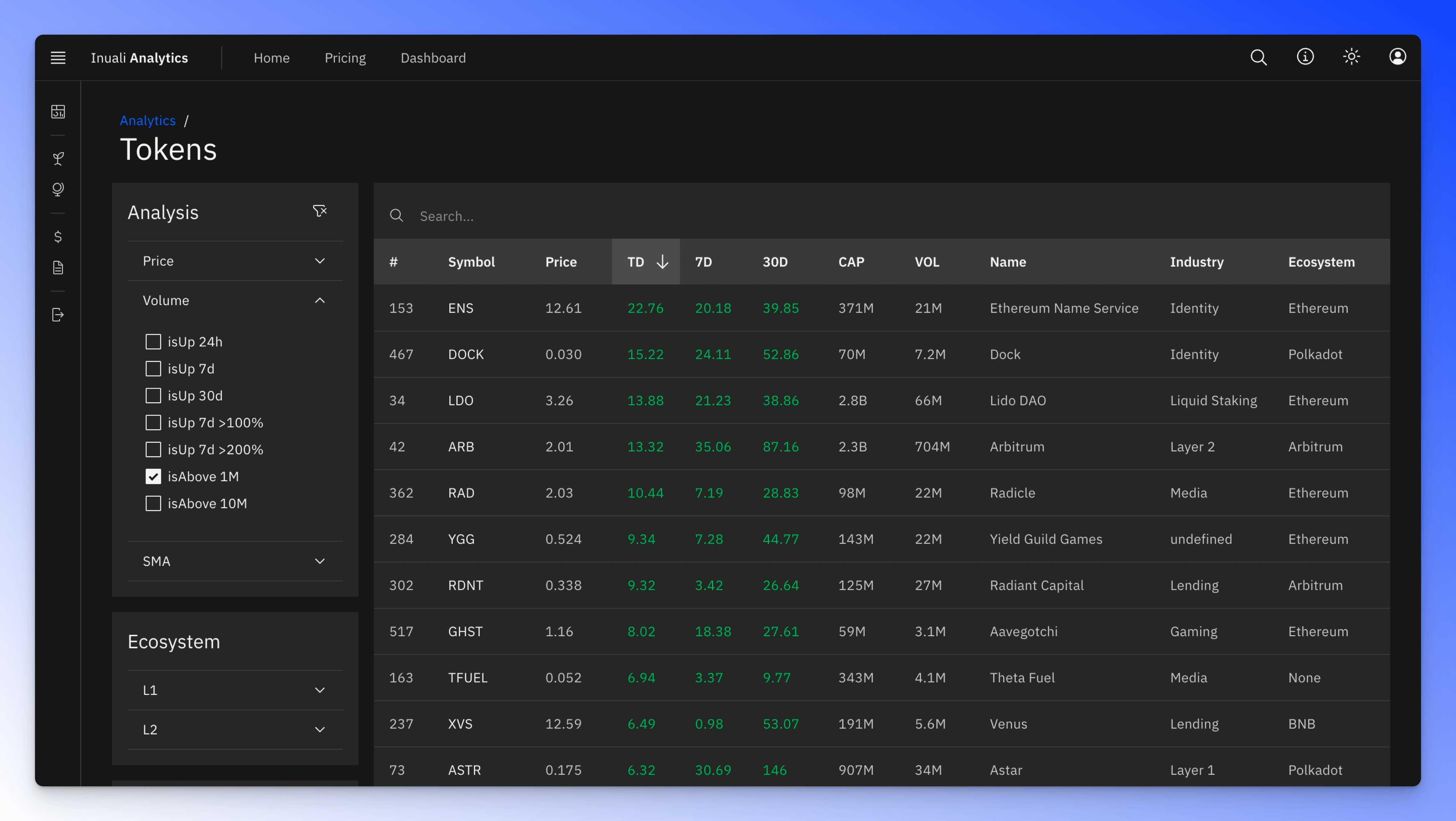

Token Table

On the day of the market drop, use the token table and sort the results by 'Today's Gains' by clicking on the TD column. This helps identify assets that are performing well even during or after the downturn.

After identifying strong tokens, analyze them in detail. Check their price charts and research online for any upcoming catalysts that might affect their value.

Compare Graphs

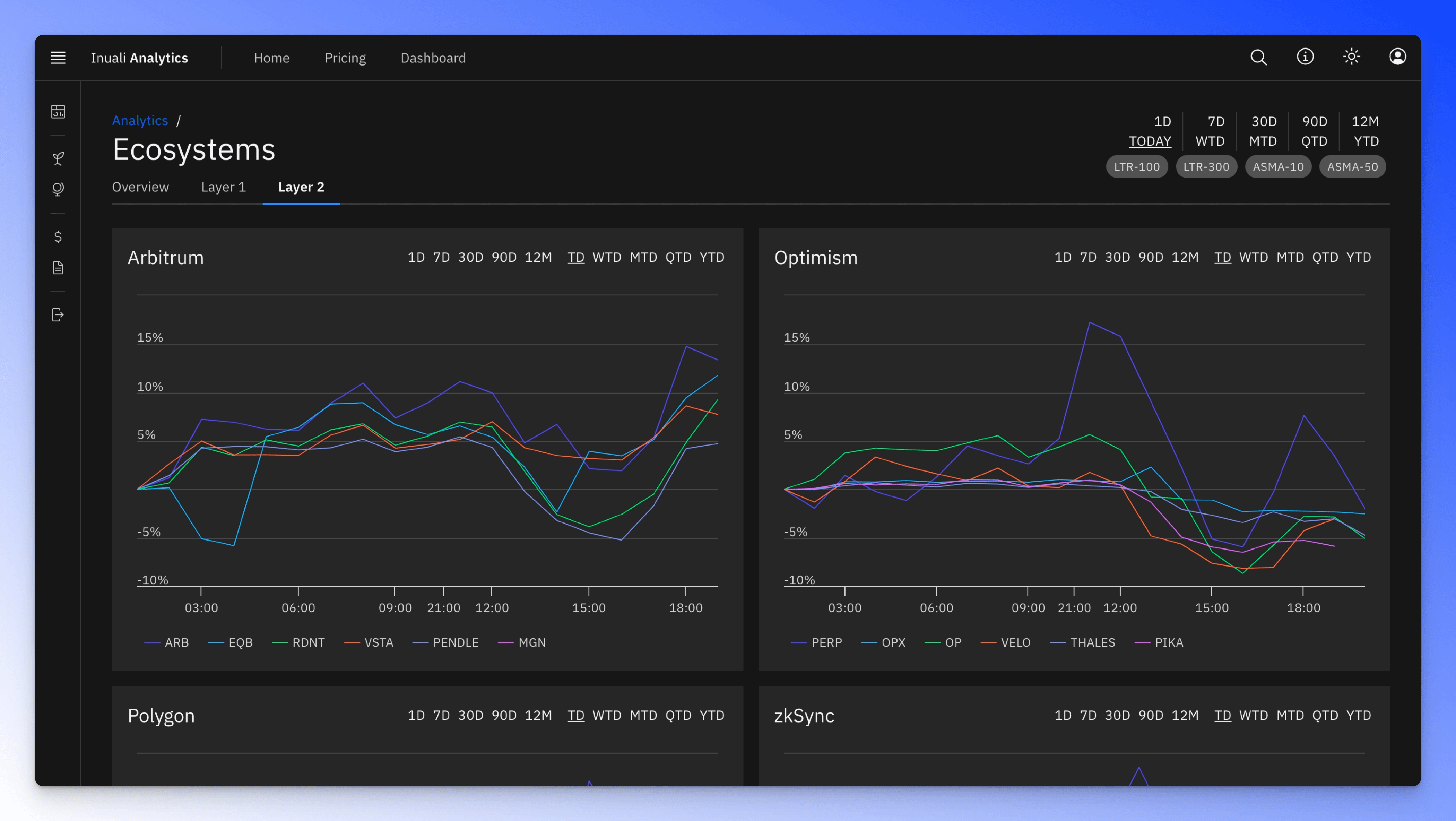

Use the 'Compare Graphs' feature, which displays the relative price performance of various assets, on the 'Today' timeframe. This allows you to identify strong assets that are performing well during a market drop within your chosen ecosystem or sector For instance, here the Arbitrum ecosystem shows a more robust recovery compared to the Optimism ecosystem following the market drop.