Sectors Overview

The Sectors Overview page provides a quick look at how various sectors are performing.

To simplify this, we've created an index for each sector. An index combines multiple data points into one number. Here, it measures the overall performance of all tokens in a specific sector.

Rather than examining many separate tokens, you can use these indexes to get a clear picture of each sector's total performance.

Algorithm Selection

The options at the top right allow you to customize how the indices are calculated:

- Algorithm: Select different calculation methods for the indices.

- Quote Currency: Compare price and market cap changes to a different asset such as BTC or ETH. For example, set the quote currency to BTC to see which blockchain indices outperform holding bitcoin.

Depending on your preferences, you can choose between the following algorithms:

- Marketcap - Standard Weight: Use when you want larger-cap tokens to have more influence on the index.

- Marketcap - Equal Weight: Choose for a more balanced representation of all tokens, regardless of market cap.

- Price Return - Marketcap Weight: Opt for this when you want to focus on price changes, with larger-cap tokens having more impact. Highly responsive to price movements, especially of higher market cap tokens.

- Price Return - Equal Weight: Select when you want to emphasize price changes equally across all tokens. Most responsive to price movements across all tokens in the index.

The default setting is Price Return - Marketcap Weight, which means the index tracks the price performance of tokens weighted by their market capitalization. This provides a balanced view of the sector's overall performance. But if you want to be ahead of the curve, you might prefer Price Return - Equal Weight. This option will respond more quickly to market shifts.

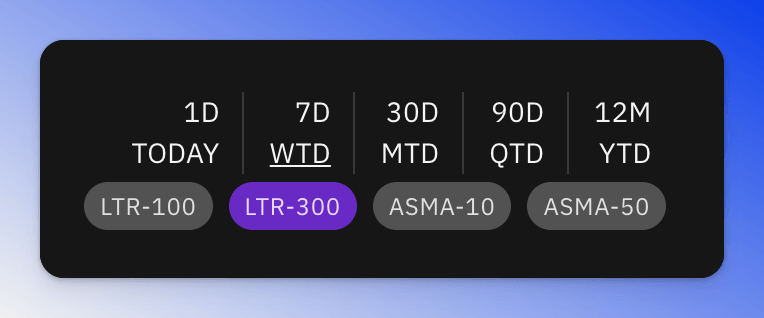

Time Range Selection

You can adjust the time range of the charts using the time settings at the top of the page. The filter section has no effect on this page.

Indices Charts

Bubble Chart

The bubble chart shows different sector indexes. It compares how their market value or price has changed over time.

- X-Axis: Marketcap or Price Change over the last 90 days on default time settings.

- Y-Axis: Marketcap or Price Change over the last 30 days on default time settings.

- Bubble Size: The size of the bubble indicates the volume change of the index.

- Bubble Color: Green, when the index trades above its Simple Moving Average 10 and 50, a bullish signal. Otherwise, Blue.

Sectors are organized into different categories like "Improving", "Leading", "Weakening" and "Lagging" based on how well they're performing. For potential future outperformers, focus on the "Leading" and "Improving" quadrant, as it highlights blockchains showing positive momentum and growth.

Hold down the left mouse button and draw a rectangle over the area you want to zoom into. Press and hold the shift key to pan.

Line Chart

The Line Chart shows how the top six sectors have performed relative compared to each other over time. You can see more details about any sector by clicking on its line in the chart.

Column Chart

The Column Chart ranks all sectors based on how well they performed. Each column's height represents the percentage increase in either market cap or price, depending on which algorithm option you choose. This increase is shown for the time period you select.

Indices Table

The table at the bottom of the page provides a numerical overview of the performance of all sectors.

-

Value: For the algorithm Marketcap - Standard Weight, this is the total of all market caps of the tokens in the index. The value is then either shown in USD or relative to the marketcap of the selected currency. For other algorithms the index value is not very useful by itself.

-

1D/7D/ETC: Marketcap or price change, relative to the selected base currency, during this time period.

Remember, you can always save your current view with its time and filter configuration as a browser bookmark.

Equal vs. Standard Weight Chart

The Equal vs. Standard Weight component allows you to compare differently weighted versions of the same index. An equal-weighted index gives more importance to smaller, lesser-known tokens compared to the standard-weighted one.

In a bull market, smaller tokens tend to outperform larger ones, so the equal-weighted index should trade above the standard-weighted one. The chart will turn green when this is the case.

The Equal vs. Standard Weight Chart has two modes:

- DIFF: Shows the difference between the Equal-weighted and Standard-weighted index.

- ABS: Displays the two different versions as normalized absolute raw data.

In DIFF mode, an upward-sloping line suggests a possible bullish trend reversal, while a downward-sloping line indicates a potential bearish reversal.

Top Volume Change

The Top Volume Chart shows sectors with the largest trading volume increases. Higher volume often hints at potential future price growth. Watching these sectors closely can be helpful for spotting market trends.

Top Tags

The Top Tags charts display the highest-performing tags during the chosen time frame and in this sector.